We permanently activate our fight-flight-freeze-appease response when constantly performing at our peak. This acute stress response activates our sympathetic nervous system and keeps us unhealthy or from experiencing deeper joy and fulfilment in life. Blogs and TED talks abound on how we’re living in an age where our stress level is way above a healthy normal, and we need to find ways to reduce our stress to enjoy more of life.

Despite our best-laid plans and most honourable intentions, conversations about money can go south quickly! There’s never going to be a perfect time to talk about money dreads or financial dreams, but preparing our partner or family for the chat, and finding a space where we won’t be interrupted is always helpful. It’s also helpful to think about what you want to say, but you can never know exactly how others will feel about it. In a recent blog from moneyhelper.org.uk, they offered several insightful ideas to help us talk to people we love when we disagree about money.

In the previous blog, we looked at how we can help our children with their retirement, or financial independence, as many in our profession are starting to frame it. But the reality is, as the sandwich generation, we can’t only be thinking about our own and our kids’ financial futures; we also need to be thinking about our parents’ financial futures.

We spend most of our time having conversations with people who are 40+ about saving for retirement. However, the language and expectations are slowly starting to shift in a powerful and exciting direction. Instead of only talking about retirement, we’re starting to use words like financial independence. And rather than focusing on traditional milestones, like 65+ years, we’re starting to look at shifting timelines based on goals and lifestyle plans that are based on purpose and meaning, not contracts and “having enough”.

“I love talking about money with my family!” said no one ever. Most of us will agree that there is more to life than money, but regardless, it’s very important for most of us — especially when we feel like we do not have enough. Money can become a consuming focus that leaves us feeling powerless and sometimes even worthless.

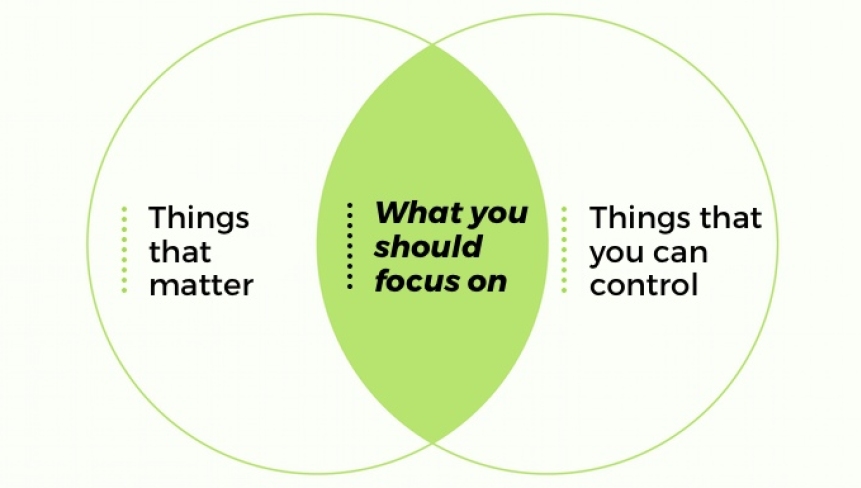

In a recent podcast on the Allan Gray Podcast with Dan Brocklemank, head of Orbis UK, he reflected on how humans are NOT designed to be good investors. Our natural instincts very often pull us in the exact opposite direction to what we need to be doing in order to be good at investing. Our natural habits and instincts protect us in the present; they’re not good at protecting us for the future and seeing the bigger picture.