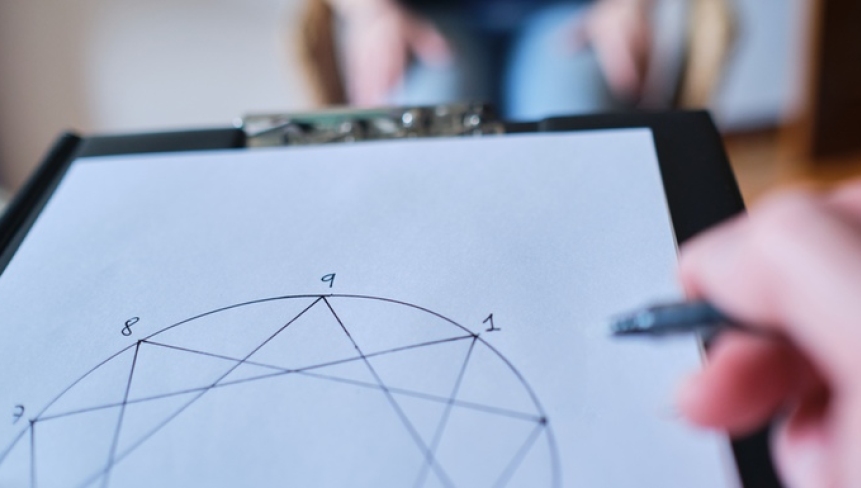

Can the Enneagram help you with your money habits?

If you're not familiar, the Enneagram is a personality typing tool that focuses on why we do what we do. It is a model of nine interconnected personality types - from the Ancient Greek word “ennea” for nine. A quick Google search will tell you what you need to know and guide you to free tests if you’d like to dig a little deeper.

Over the last few decades, the Enneagram has grown in popularity, proving helpful in conversations of meaning, value and understanding our core motivations. It enables us to spot patterns in our behaviours that speak to our intrinsic fears, triggers and unbridled inspiration. From how we spend money to how we react to the neighbour's dog barking all night - the Enneagram can open our eyes to habits that keep us in a place where we feel stuck, frustrated and unhappy.

Money is a common blockage for many of us. Whether it’s a debt trap into which we keep falling, or an inability to enjoy our hard-earned moola, when we can see how our motivations influence our money habits, we can decide if and how we might change our situation.

Here are some money management tips from the Real Simple blog - let’s jump straight in! (Link at the end)

Type One: The Reformer

Let go of judgement around your spending, as this only leads to harsher self-criticism. Check in with your values around what you want, assess how much it will cost, and set a little money aside each paycheck.

Type Two: The Helper

Ask yourself: Do you need this right now? Are you saying yes to spending on something to please others? This will allow you to save for what you truly love—even if it's in baby steps.

Type Three: The Achiever

When you feel compelled to spend, check in with your true intentions. Is it to impress others? Is it to keep up with a trend? The clearer you are on your priorities, the more you'll be able to invest in things that speak to your innermost happiness.

Type Four: The Individualist

You may not want to hear the B-word, but budgeting is your best friend when managing your money. Grab a pretty notebook and some coloured pens, and plan how much you'll spend and save. Why? It will help you prioritise the bigger things that fill you with joy and purpose.

Type Five: The Investigator

Recognise how money can provide that sense of freedom and autonomy you desire. Create a "treat yourself fund" in your monthly budget that allows you to spend on experiences you love, whether it is a book you want or a friend you want to spoil. You may be surprised how much this opens up in you.

Type Six: The Loyalist

Take the time to understand your finances, from investing to budgeting and everything in between. Not only do you love learning new things, but this will help you feel more prepared to make those more significant decisions instead of letting fear drive your actions.

Type Seven: The Enthusiast

The trap of the Seven is "shiny object syndrome" and wanting new things to feel satisfied. Before handing over your credit card, reflect on your long-term goals vs instant gratification. Is spending money right now filling a void you're not tending to? When you realise you have enough and are enough, you will find satisfaction that money can't buy (and save more along the way).

Type Eight: The Challenger

Notice where you are spending money as a way to feel in control. Do you need to buy things in bulk every month? Do you buy products you don't end up using? When you feel the impulse to spend, consider how your future self will feel. It may be a wiser decision to invest your money to build wealth over time.

Type Nine: The Peacemaker

Create a vision board for your finances. Not only does this get you to take action, but it'll help you get clear on your priorities and build a structure. Get crafty by cutting out images and words that speak to your goals, and make sure everything is measurable so you can track your progress.

If reading through this has helped uncover some blindspots, or sparked some more questions on how you feel, think and behave with your money, please feel free to reach out for a chat.

0 Comments